Off plan- Think before you sign!

by David Moss.

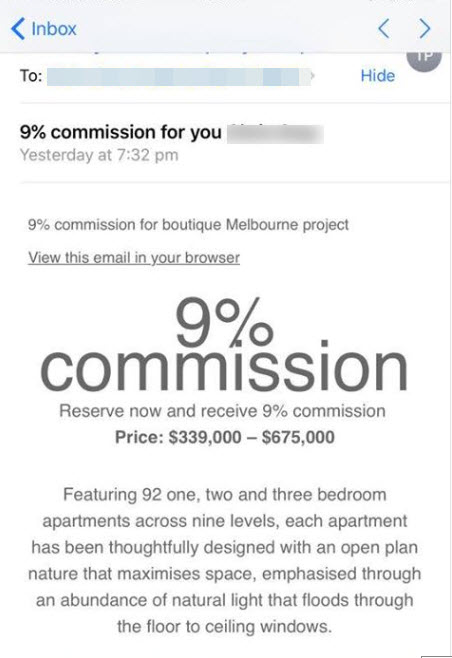

Buying off plan? I received this today. (see photo attached) Its alarming to say the least and I’m seeing it all too often.

Most days, I speak to consumers in SG that have purchased off plan properties in Australia.

Some of these properties (not all) have been marketed by local & Aussie agents acting on behalf of Aussie property developers. Some purchasers have even encountered mortgage brokers & financial planners (both Aus & local) now selling properties in addition to their core services.

This particular offer mentions ridiculous commissions for referring potential purchases for off plan developments. Can you imaging that a simple $675k purchase would offer the referrer a 9% commission?? That’s $60750. It makes you wonder just how much margin is built into the unit pricing.

There’s an old saying, “if something looks too good to be true, normally it is” comes to mind.

From a finance lending perspective, I’m seeing more and more low bank valuations. More often than not, many clients are puzzled by the bank appraisal process and were convinced they were purchasing a super investment- or at least that’s what the agent, broker or glossy brochure told them! “How can something I purchased several years ago be less in value”? Of course, market conditions can play a big part in the valuation process which means there’s a potential element of risk or gain associated with purchasing off plan.

When purchasing an off plan unit, you can take measures to by doing basic due diligence.

Here’s some simple advice:

-

Ask the agent to provide evidence of similar properties that have sold recently?

-

Compare those against the size of the unit you’re purchasing.

-

Compare your units location, aspect and location features.

-

What are the fixtures and fittings?

-

How many other developments are being being built in the location?

-

Ask which countries has the development unit has been marketed? Will those purchases be able to settle on their purchase? Many banks have restricted lending to many countries.

Alternatively, consider using a trusted licensed buyers agent. The good ones will do all this research for you and should be able to justify their fees.

Just remember, fancy or glossy brochures won’t picture another condo being built in front of your unit but will emphasise pictures of happy families, schools and nearby hospitals. Sounding too good to be true “incentives and rebates” are often factored into price.

Rest assured, the banks valuers will follow similar guidelines when it comes to valuation time.

Some simple due diligence can go along way to protecting you financially when purchasing an off plan unit. Fortunately, I see many purchases that come in very well valued come T.O.P time- I can assure you, they’re not units being marked with amazing incentives and purchasers are the savvy ones that have done due diligence! Find the right property for your situation and not one that lines an agents or brokers pockets who in some cases, will be long gone come settlement time.

Trackback from your site.